Pioneering The Future Of

Finance

Energy

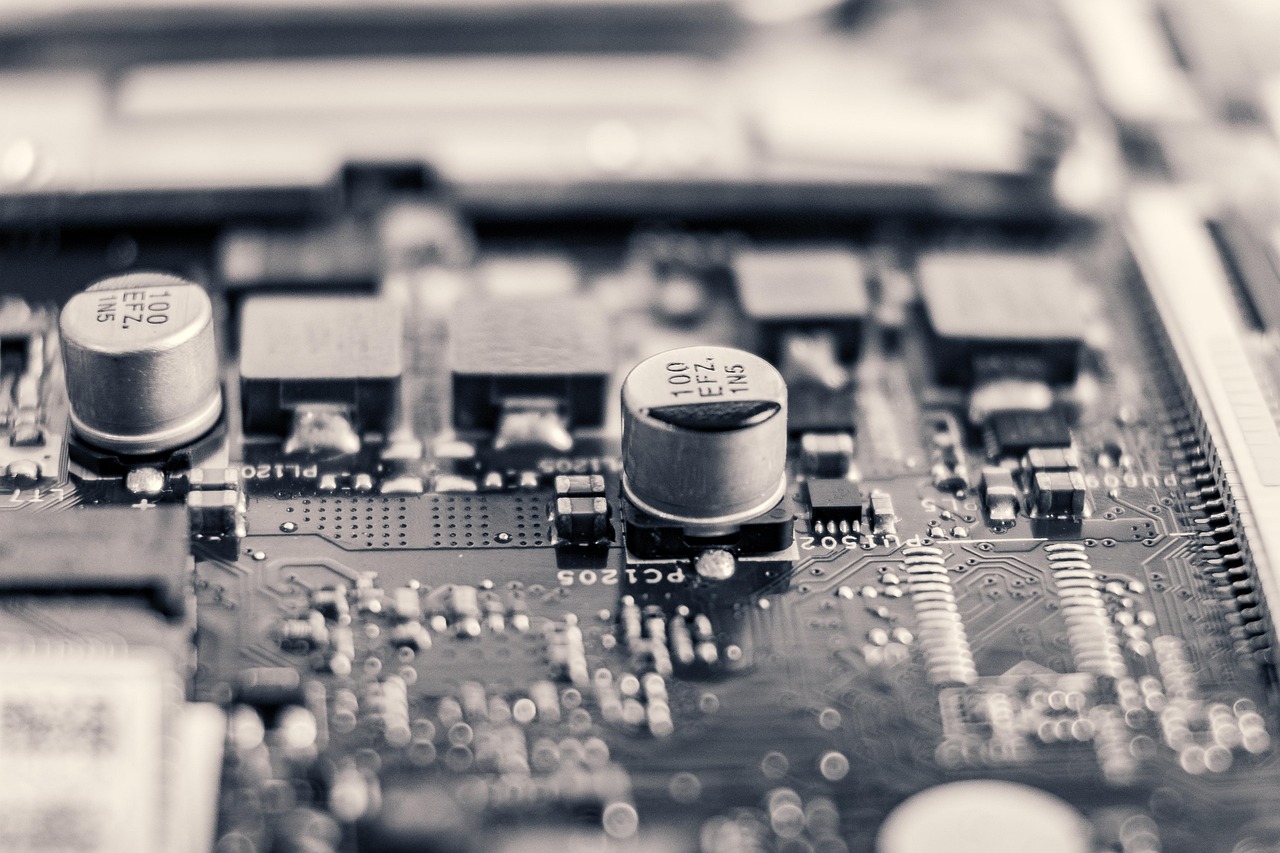

Computing

By supporting bold founders with deep technical / operational expertise, global network and capital.

Our Philosophy Building The Future

We believe in bold ideas that reshape industries with resilience and innovation. At Cloudberry Pioneer Investments, sustainability and long-term impact are at the core of everything we do.

Our founder-first approach prioritizes passion and impact over convention. We operate globally, unconstrained by mandates, investing wherever vision aligns with ours. We are happy to join at any stage with a meaningful ticket size.

Thesis

Our fund invests in transformative startups across Fintech, Climate Tech, and High-Performance Computing. We focus on companies driving innovation in areas like tokenization of real-world assets, scalable renewable energy technologies, and next-generation computing breakthroughs like quantum computing, driven by advancements in photonics, alternative materials and new architectures. By targeting early-stage leaders, we aim to create long-term impact and deliver exceptional returns.

Portfolio

Our portfolio companies are reshaping industries by tackling complex global challenges. From advancing edge AI compute, quantum computers that can operate in room temperature, disrupting global payments to driving the transition to clean energy, they embody bold thinking and transformative impact. At Cloudberry Pioneer Investments, we empower these trailblazers to create lasting change and redefine the future.

Investment Thesis

At Cloudberry Pioneer Investments, we invest in startups solving the world’s toughest challenges in Fintech, Renewable Energy, and High-Performance Computing. Our focus is on transformative ideas that balance innovation, scalability, and impact.

Tokenization

Companies that are driving efficiencies and enabling faster, more secure payments through compliant solutions, with a particular emphasis on the tokenization of Real World Assets (RWA). Our focus is on businesses that are leveraging this technology to solve specific challenges in cross-border payments, lending, and trade finance, thereby creating value by reducing transaction costs, increasing transparency, and enhancing liquidity.

Decarbonization

Companies at the forefront of creating disruptive technologies that harness advancements in material science, robotics, artificial intelligence, low-carbon energy sources and agriculture. These innovations are not only pivotal in supporting global decarbonization efforts but also play a critical role in reducing operational costs and driving sustainable economic growth. Our focus is on scalable solutions that address the growing demand for sustainability, with a strong emphasis on market leadership and long-term impact.

Computing

Companies that are pioneering the key enablers of next-generation high-performance computing technologies. Our focus is on technologies transforming foundational computing platforms and infrastructure through new breakthroughs in photonics, new architectures like brain inspired neuromorphic computing or material innovation in the form of ultra-thin 2D materials to replace silicon. And last but not least through new paradigms in physics like Quantum Computing where advancements in quantum error correction (QEC), quantum networks / QKD and the development of new materials aimed at reducing qubit error rates or help computers to operate in room temperature. These innovations are essential for unlocking the full potential of computing, driving transformative applications across various industries.

Our Why

We believe technology can drive global progress, and founders with bold visions need partners who share their ambition. By aligning our investments with critical global trends, we aim to catalyze change while delivering exceptional returns.

Our Portfolio

Why We Invested

Why We Invested

Why We Invested

Why We Invested

Why We Invested

Why We Invested

Portfolio News

Fisent Technologies Raises $2 Million to Date with Follow-On Seed Round

Fisent Technologies, a pioneer in Applied GenAI Process Automation, has extended its seed round, bringing its total investment to date to $2 million USD led by Cloudberry Pioneer Investments… (source)

Quantum Brilliance secures $20M for portable diamond-based accelerators

Australian-German startup Quantum Brilliance has raised $20mn in Series A funding as it looks to deploy small, portable quantum accelerators that promise to supercharge the computational power of everything from data centres and robots to satellites. (source)

Syntiant completes acquisition of Knowles’ consumer MEMS microphone division

Syntiant, a leading developer of low power edge AI deployments, has completed the acquisition of Knowles Corporation’s Consumer MEMS Microphones (CMM) business for $150 million. (source)

HYDGEN Raises $1.5M to Expand Decentralized Green Hydrogen Solutions

HYDGEN (Hydrogen Innovation Pte. Ltd), a leading innovator in decentralized green hydrogen production, has successfully closed a seed funding round raising close to SGD 2 million, led by Cloudberry Pioneer Investments, with participation from the National University of Singapore.(source)

Team Members

The founding members include a serial entrepreneur with multiple exits, offering invaluable experience in scaling ventures, and a tech executive with two decades of leadership experience at Google and Oracle. Complemented by an experienced investment team and Venture Partners, they bring a powerful combination of expertise and human power to identify, support, and grow high-potential startups.

Mahir Sahin

Founding Partner

Mahir Sahin

Founding Partner

Mahir is a seasoned venture capitalist and technology leader with over two decades of experience driving innovation and growth across global markets. As a former executive at Google for 16 years, he held key leadership roles, including Advisor to Alphabet’s deeptech-focused X, the moonshot factory, where he helped scale transformative technologies and unlock new market opportunities. Prior to Google, he led European business development for enterprise software sales at Oracle.

Mahir’s extensive international experience and deep understanding of technology and business strategy make him a trusted partner to startups, offering both strategic guidance and a global perspective. He holds an MSc in Business Administration from the Technical University of Berlin.

When not collaborating with entrepreneurs, Mahir enjoys tennis, yoga, and exploring the world with his wife, drawing inspiration from the cultures and ideas he encounters.

Jane Choi

Investment Associate

Jane Choi

Investment Associate

With a MEng in Astronautics and Spacecraft Engineering from University of Southampton, Jane began her career in Spacecraft Operations at Eutelsat OneWeb with a strong focus on Mission Planning. By leveraging her Cloud and Hybrid Infrastructure knowledge, Jane transitioned into a DevOps Technical Lead role at a high-growth Fintech, whilst also advising startups on growth and strategy. With a focus on the DeepTech verticals, specifically Space, Robotics and Quantum, Jane is also an Angel Investor and leverages her technical insights to support the Cloudberry Investment Team.

Outside of work, Jane enjoys training in Muay Thai and Boxing. She is particularly inspired by the mental resilience, focus, and discipline demonstrated by professional MMA athletes, and she aims to carry those values into both personal and professional pursuits.

Katrin Wilking

Investment Associate

Katrin Wilking

Investment Associate

With a Master of Law from King’s College London, where she focused on the role of innovation, venture capital, and the energy transition/greentech, and legal qualification in Germany, Katrin brings a unique perspective to Cloudberry. She combines M&A and venture capital experience from Taylor Wessing with operational startup insights from her role at a LegalTech company in Berlin. She specializes in helping early-stage companies navigate complex regulatory environments and scale across international markets, drawing on her experience across London, Lausanne, and Vancouver. At Cloudberry, she conducts legal due diligence, supports portfolio companies on regulatory strategy, and identifies investment opportunities.

Outside of work, Katrin enjoys all kinds of sports, particularly outdoor activities like running and hiking. She loves traveling and a good coffee.

Christopher Krischnig

Advisor & Founding Member

Christopher Krischnig

Advisor & Founding Member

Chris is a dynamic serial entrepreneur and venture capitalist with a proven track record of building and scaling companies to high-value exits. Over his career, Chris has founded and led multiple ventures to successful high eight-figure outcomes, cementing his reputation as a leader in creating value through innovation and strategic vision.

As an advisor and investment committee member to Cloudberry Pioneer Investments, Chris combines his entrepreneurial expertise with a deep understanding of emerging markets to identify and nurture the next generation of transformative businesses. He holds an MSc in Business Administration from the University of Graz.

Outside of work, Chris is an avid surfer and tennis enthusiast, embracing the challenge and joy these sports bring. His favorite way to spend his time, however, is with his wife, two daughters, and their Labrador Charlie. This balance of professional drive and personal fulfillment defines Chris’s approach to life and work, making him a trusted partner to both entrepreneurs and investors alike.

Dr. Barbara Stampf

Venture Partner - BD & Executive Search

Dr. Barbara Stampf

Venture Partner - BD & Executive Search

With 25 years of experience, Barbara has helped tech companies grow by matching them with the right talent, partners, and investors. Her focus has been on executive search, particularly for top managers, sales, and technical roles. She began her career in national and international human resources (HR) management roles with leading semiconductor companies Philips and NXP, where she played a leading role in supporting the scaling a new business segment across different ownership phases.

Leveraging this background, she was also able to help build the family’s ad tech company. All of her experiences taught her one important lesson: that the right match is critical to a company’s success. It is literally the beginning of everything, no matter if it is the right business partner, a new leader or a business angel. Barbara is a people person and that is why she is a business person, as people are the ultimate fundament of a company’s success. That experience in deep tech and her personality make her the right match for our fund.

Benedikt Knobloch

Venture Partner - Ecosystem Development

Benedikt Knobloch

Venture Partner - Ecosystem Development

Benedikt is a serial entrepreneur with over 12 years of experience in the restaurant technology sector. While selling his last company, he teamed up with an experienced team to found Souschef Ventures – a venture capital firm dedicated to supporting early-stage startups tackling the most pressing challenges in the food service and food supply chain industries. Besides that, he has been an active angel investor for nearly 10 years.

At Cloudberry Pionner Investments, Benedikt draws on his operator experience and sharp eye for early-stage breakout potential. He is deeply embedded in the European venture landscape, with a strong network of top-tier funds and founders across the continent. His focus is on helping exceptional teams build at the edge of regulation, data, and capital flows.